美国硕士保证金多少

Title: Exploring a Master's Degree in Insurance in the United States

Introduction (150 words):

Earning a Master's degree in Insurance in the United States can provide a solid foundation for a rewarding career in the insurance industry. This advanced program equips students with the necessary skills and knowledge to navigate the complex world of insurance, risk management, and financial planning. In this article, we will explore the benefits of pursuing a Master's degree in Insurance in the United States, the curriculum and areas of specialization within the program, potential career paths, and guidance for prospective students.

I. Benefits of Pursuing a Master's Degree in Insurance (300 words):

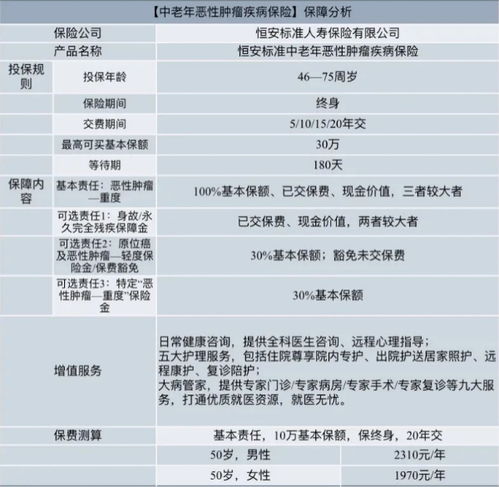

Comprehensive Knowledge: A Master's degree in Insurance offers indepth knowledge of risk management, insurance law, underwriting, claims management, and actuarial science, providing a comprehensive understanding of the insurance industry.

Competitive Advantage: Graduates with a Master's degree in Insurance possess a competitive edge in the job market, as employers recognize the value of specialized education and expertise in this field.

Networking Opportunities: Students have the opportunity to build relationships with industry professionals, faculty, and fellow students, creating a valuable network of contacts for future career prospects.

Professional Accreditation: Some programs offer opportunities to pursue professional certifications, such as the Chartered Property Casualty Underwriter (CPCU) designation, further enhancing credibility and employability.

II. Curriculum and Areas of Specialization (400 words):

Core Courses: The curriculum typically includes courses in risk management, insurance operations, insurance law, actuarial science, financial planning, and quantitative analysis.

Specializations: Students can choose to specialize in areas such as underwriting, claims management, insurance marketing, risk analysis, or actuarial science, tailoring their education to align with their career goals.

Elective Courses: Programs may offer elective courses covering advanced topics such as cyber insurance, healthcare insurance, international insurance markets, or insurance regulation and compliance.

III. Potential Career Paths (400 words):

Insurance Underwriter: Assessing risk, determining coverage, and setting premiums for insurance policies based on data analysis and industry knowledge.

Claims Adjuster: Investigating insurance claims, evaluating damages or losses, and facilitating settlements.

Risk Analyst: Analyzing potential risks faced by individuals or organizations and developing strategies to manage and mitigate those risks.

Actuary: Applying mathematical and statistical methods to assess and manage financial risks, primarily related to insurance programs.

Insurance Broker/Agent: Selling insurance policies to clients and providing them with guidance on the most appropriate coverage options.

Risk Manager: Identifying, assessing, and managing risks within an organization to minimize potential losses and protect assets.

Guidance for Prospective Students (250 words):

Research Programs: Explore different universities and programs offering a Master's degree in Insurance to find the best fit for your career goals and personal preferences.

Prerequisites: Review the admission requirements, which may include a bachelor's degree in a related field, standardized test scores (such as the GMAT or GRE), letters of recommendation, and a statement of purpose.

Financial Aid: Research scholarship or financial aid opportunities offered by universities, private organizations, and government agencies to support your education.

Internships and Networking: Seek opportunities for internships or parttime work in insurance companies during your studies to gain practical experience and expand your professional network.

Professional Certification: Consider pursuing professional certifications, such as CPCU or Certified Risk Manager (CRM), to enhance your credentials and increase job prospects.

Conclusion (100 words):

A Master's degree in Insurance equips students with specialized knowledge and skills necessary for successful careers in the insurance industry. By gaining a comprehensive understanding of insurance operations, risk management, and financial planning, graduates can pursue diverse opportunities as underwriters, claims adjusters, risk analysts, actuaries, insurance brokers/agents, or risk managers. Thorough research and careful selection of the right program will ensure that students make the most of their educational journey and achieve their professional goals.