两癌保险包括意外伤害吗

Understanding Dual Cancer Insurance Coverage

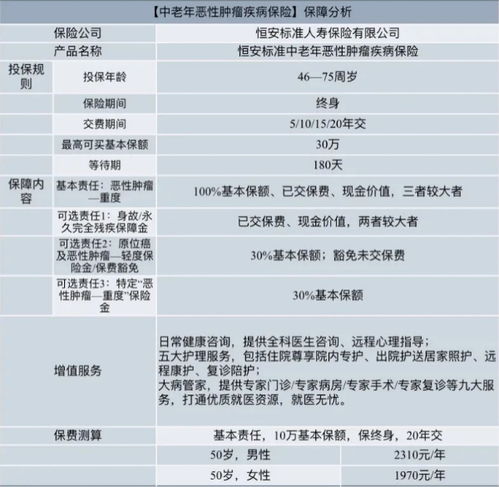

In today's world, where the prevalence of cancer is alarmingly high, having adequate insurance coverage is paramount. Dual cancer insurance, also known as multiple cancer insurance, is a specialized form of coverage designed to provide financial protection in the event of a dual diagnosis of cancer. Let's delve into what this type of insurance entails and how it can offer peace of mind in challenging times.

What is Dual Cancer Insurance?

Dual cancer insurance is a type of supplemental insurance policy that specifically covers the diagnosis and treatment of two separate primary cancers. Unlike traditional health insurance, which may have limitations on coverage or require high outofpocket expenses for cancer treatments, dual cancer insurance offers additional financial support tailored specifically to the unique challenges of facing multiple cancer diagnoses.

Key Features and Benefits

1.

Coverage for Multiple Cancer Diagnoses

: The primary feature of dual cancer insurance is its coverage for two distinct primary cancers. This means that if you are diagnosed with cancer in one part of your body and later develop cancer in another unrelated part, the policy will provide benefits for both diagnoses.2.

Financial Assistance for Treatment Costs

: Cancer treatment expenses can be exorbitant, including costs for surgery, chemotherapy, radiation therapy, medications, and hospitalization. Dual cancer insurance can help alleviate the financial burden by providing lumpsum payments or reimbursements for these expenses.3.

Income Replacement

: During cancer treatment, individuals may need to take time off work or reduce their working hours, resulting in a loss of income. Dual cancer insurance may offer benefits to replace a portion of lost income, helping policyholders maintain financial stability while focusing on their recovery.4.

Flexibility in Benefit Utilization

: Unlike some traditional health insurance policies that dictate how benefits can be used, dual cancer insurance typically provides policyholders with flexibility in utilizing benefits. Whether it's covering medical bills, household expenses, or alternative therapies, policyholders have the discretion to allocate funds where they are needed most.5.

No Coordination with Other Insurance

: Dual cancer insurance operates independently of any existing health insurance coverage. This means that benefits are payable regardless of whether or not the policyholder has other health insurance policies in place.Considerations and Recommendations

1.

Assess Your Existing Coverage

: Before purchasing dual cancer insurance, evaluate your current health insurance policy to understand what cancerrelated expenses are already covered. Identifying potential gaps in coverage can help you determine the level of supplemental insurance you need.2.

Understand Policy Limitations

: Like any insurance policy, dual cancer insurance may have limitations and exclusions. Review the terms and conditions carefully to understand what is covered, any waiting periods before benefits are payable, and any restrictions on preexisting conditions.3.

Compare Policies

: Insurance providers offer a variety of dual cancer insurance policies with different coverage limits, premiums, and terms. Take the time to compare policies from multiple insurers to find one that best fits your needs and budget.4.

Consider Your Medical History

: Individuals with a family history of cancer or other risk factors may have a higher likelihood of facing multiple cancer diagnoses. If you fall into this category, investing in dual cancer insurance can provide added peace of mind.5.

Consult with an Insurance Advisor

: If you're uncertain about which insurance options are best for you, consider seeking guidance from a qualified insurance advisor. They can provide personalized recommendations based on your individual circumstances and help you navigate the complexities of insurance policies.Conclusion

Dual cancer insurance serves as a valuable supplement to traditional health insurance, offering additional financial protection in the event of multiple cancer diagnoses. By understanding its features, benefits, and considerations, individuals can make informed decisions to safeguard their financial wellbeing in the face of cancerrelated challenges. Remember to thoroughly research policies, assess your needs, and consult with professionals to ensure you select the right coverage for your situation.